Description

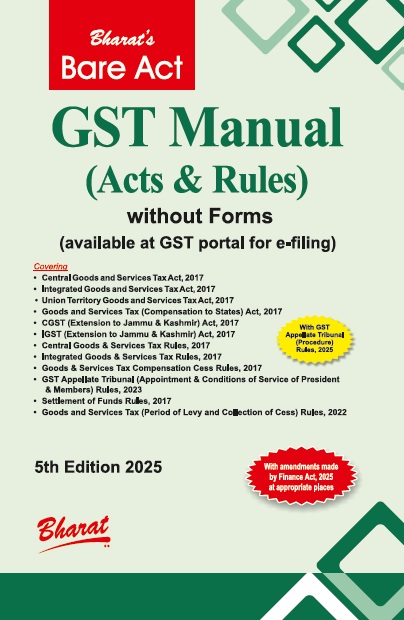

The GST Manual (Acts & Rules) is a comprehensive guide designed to provide detailed insights into the Goods and Services Tax (GST) system in India. It encompasses the various laws, acts, and rules governing the implementation of GST, serving as a crucial resource for businesses, tax professionals, and government authorities.

This manual covers:

-

GST Acts: Provides in-depth information about the Goods and Services Tax Act, including the key provisions, structure, and scope of GST in India.

- GST Rules: Outline practical guidelines for applying and interpreting the GST Act, covering areas like registration, tax payments, and returns.

TABLE OF CONTENTS

Chapter 1 Central Goods and Services Tax Act, 2017

Chapter 2 Integrated Goods and Services Tax Act, 2017

Chapter 3 Union Territory Goods and Services Tax Act, 2017

Chapter 4 Goods and Services Tax (Compensation to States) Act, 2017

Chapter 5 Central Goods and Services Tax (Extension to Jammu and Kashmir) Act, 2017

Chapter 6 Integrated Goods and Services Tax (Extension to Jammu and Kashmir) Act, 2017

Reviews

There are no reviews yet.