-

-10%

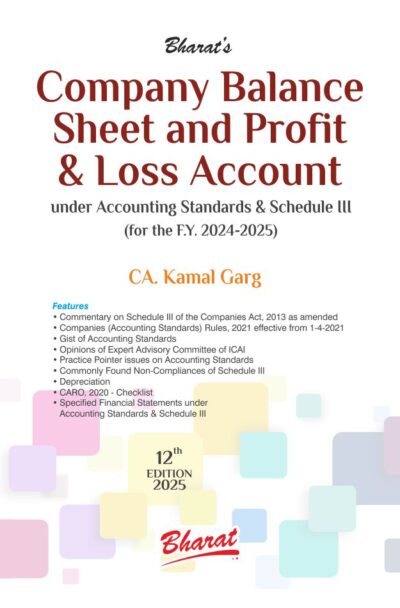

Company Balance Sheet and Profit & Loss Account

0Original price was: ₹2,850.00.₹2,565.00Current price is: ₹2,565.00.Streamline your financial management with our easy-to-use Company Balance Sheet & Profit & Loss Account template. Tailored for businesses, accountants, and startups, this template helps you monitor assets, liabilities, revenue, and expenses. Perfect for integrating with WooCommerce, it offers a comprehensive solution to track your company’s financial performance.

-

-10%

Handbook on TAX DEDUCTION AT SOURCE

0Original price was: ₹750.00.₹675.00Current price is: ₹675.00.Master TDS with the 2024 Handbook on Tax Dedication at Source. Includes latest rules, rates & filing processes. A trusted guide for tax professionals, CAs & business owners. Shop now!

-

-10%

QUALIFICATIONS & Other Comments in the Auditor’s Report

0Original price was: ₹1,395.00.₹1,255.00Current price is: ₹1,255.00.The “Qualifications & Other Comments” section in an Auditor’s Report highlights any exceptions or deviations from standard accounting practices and regulatory compliance. This section provides transparency by identifying areas of concern such as non-compliance with accounting standards, operational inefficiencies, financial inconsistencies, or limitations encountered during the audit process.

-

-99%

TAX PLANNING – PRACTICAL ASPECTS

0Original price was: ₹1,295.00.₹11.00Current price is: ₹11.00.Discover smart tax-saving techniques with “Tax Planning – Practical Aspects.” A must-have guide for professionals & businesses. Updated for FY 2024-25 with practical case studies & legal insights.