-

-18%

Factories Act, 1948 with FAQs

0Original price was: ₹220.00.₹180.00Current price is: ₹180.00.A reader-friendly guide to the Factories Act, 1948 with FAQs, case law tables, and illustrations. Designed for students and professionals involved in industrial law and labour compliance.

-

-10%

A B C of G S T

0Original price was: ₹1,295.00.₹1,165.00Current price is: ₹1,165.00.A section-wise and rule-wise simplified guide to GST law covering the CGST Act and Rules with integrated forms, schedules, procedures, and amendments till 2025. Ideal for practitioners, students, and tax officers.

-

-8%

A Practical Approach to TAXATION AND ACCOUNTING

0Original price was: ₹3,250.00.₹2,995.00Current price is: ₹2,995.00.Get complete insights into tax compliance, accounting, GST, FCRA & 80G/12AB registration for NGOs, Trusts & NPOs. Buy the 2024 edition of “A Practical Approach to Taxation and Accounting” now!

-

-10%

All About Trusts & NGOs

0Original price was: ₹1,895.00.₹1,705.00Current price is: ₹1,705.00.Master the essentials of Trusts & NGOs in India with this in-depth guide. Get expert insights on legal registration, income tax benefits (12A, 80G), FCRA compliance, and management. Ideal for non-profit founders, lawyers, and social entrepreneurs. Buy now for a step-by-step roadmap to non-profit success!

-

-10%

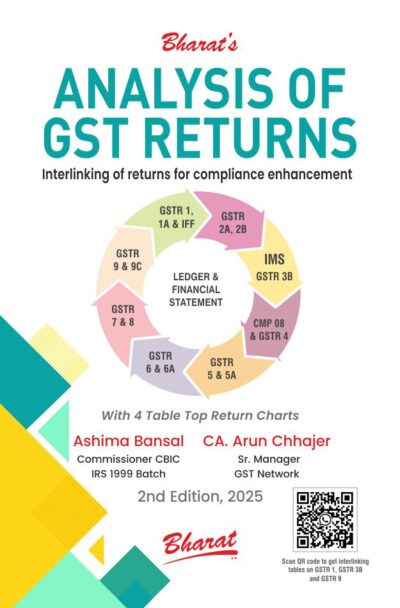

ANALYSIS OF G S T RETURNS

0Original price was: ₹1,195.00.₹1,075.00Current price is: ₹1,075.00.A structured guide to understanding, analyzing, and interlinking various GST returns like GSTR-1, GSTR-3B, GSTR-9, and 9C, along with compliance procedures for CMP-08, GSTR-5, GSTR-6, and others.

-

-10%

Beginner’s Guide to Ind-AS & IFRS

0Original price was: ₹795.00.₹715.00Current price is: ₹715.00.Explore our easy-to-understand Beginner’s Guide to Ind-AS & IFRS. Learn key concepts, differences, and benefits of global accounting standards. Perfect for students, professionals, and finance enthusiasts. Download now for simplified financial learning.

-

-10%

CAPITAL GAINS (Law & Practice) with Illustrations & Judicial Precedents

0Original price was: ₹2,350.00.₹2,115.00Current price is: ₹2,115.00.A practical and updated guide to capital gains taxation in India, with illustrations, case laws, and Finance Act 2025 amendments—ideal for tax professionals, consultants, and students.

-

-10%

Company Balance Sheet and Profit & Loss Account

0Original price was: ₹2,850.00.₹2,565.00Current price is: ₹2,565.00.Streamline your financial management with our easy-to-use Company Balance Sheet & Profit & Loss Account template. Tailored for businesses, accountants, and startups, this template helps you monitor assets, liabilities, revenue, and expenses. Perfect for integrating with WooCommerce, it offers a comprehensive solution to track your company’s financial performance.

-

-10%

COMPANY LAW PROCEDURES & COMPLIANCES (in 2 volumes)

0Original price was: ₹4,995.00.₹4,495.00Current price is: ₹4,495.00.A detailed and updated 2-volume guide to company law procedures and compliances under the Companies Act, 2013 with formats, resolutions, notices, and step-by-step guidance for professionals.

-

-10%

Company Meetings

0Original price was: ₹1,495.00.₹1,345.00Current price is: ₹1,345.00.Ensure your company meets legal standards with our comprehensive guide on conducting meetings as per the Companies Act, 2013 & SEBI LODR Regulations, 2015. Learn about board meetings, AGMs, and EGMs for seamless compliance and corporate governance.

-

-10%

Competition Law & Digital Markets in India

0Original price was: ₹795.00.₹715.00Current price is: ₹715.00.Explore the evolving dynamics of digital markets under Indian competition law. A must-have for law students, professionals, and researchers in the digital economy.

-

-10%

Complete Guide to REASSESSMENT u/s 148 of the Income Tax Act, 1961

0Original price was: ₹1,195.00.₹1,075.00Current price is: ₹1,075.00.An in-depth guide to reassessment under Section 148 of the Income Tax Act, covering procedures, legal interpretations, judicial precedents, and practical tools for professionals.

-

-10%

Employees’ Provident Funds & Misc. Provisions Act, 1952 with FAQs

0Original price was: ₹325.00.₹292.00Current price is: ₹292.00.A simplified and comprehensive guide to the EPF & MP Act, 1952 with FAQs, schemes, rules, and case law—ideal for HR professionals, legal practitioners, and students.