Description

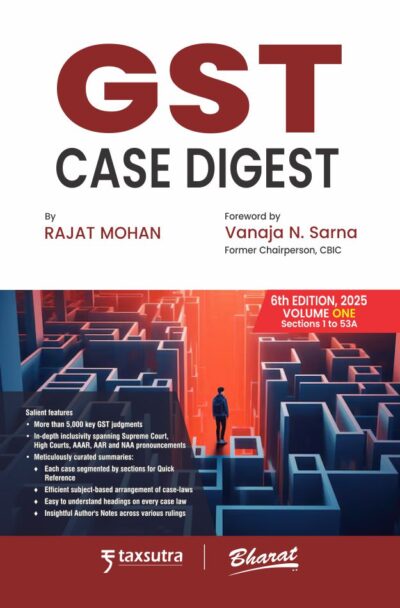

About GST Case Digest (in 2 volumes)

| Volume 1

The Central Goods and Services Tax Act, 2017 Chapter I Preliminary 1. Short title, extent and commencement 2. Definitions (1) “actionable claim” (2) “address of delivery” (3) “address on record” (4) “adjudicating authority” (5) “agent” (6) “aggregate turnover” (7) “agriculturist” (8) “Appellate Authority” (9) “Appellate Tribunal” (10) “appointed day” (11) “assessment” (12) “associated enterprises” (13) “audit” (14) “authorised bank” (15) “authorised representative” (16) “Board” (17) “business” (18) * * * (19) “capital goods” (20) “casual taxable person” (21) “central tax” (22) “cess” (23) “chartered accountant” (24) “Commissioner” (25) “Commissioner in the Board” (26) “common portal” (27) “common working days” (28) “company secretary” (29) “competent authority” (30) “composite supply” (31) “consideration” (32) “continuous supply of goods” (33) “continuous supply of services” (34) “conveyance” (35) “cost accountant” (36) “Council” (37) “credit note” (38) “debit note” (39) “deemed exports” (40) “designated authority” (41) “document” (42) “drawback” (43) “electronic cash ledger” (44) “electronic commerce” (45) “electronic commerce operator” (46) “electronic credit ledger” (47) “exempt supply” (48) “existing law” (49) “family” (50) “fixed establishment” (51) “Fund” (52) “goods” (53) “Government” (54) “Goods and Services Tax (Compensation to States) Act” (55) “goods and services tax practitioner” (56) “India” (57) “Integrated Goods and Services Tax Act” (58) “integrated tax” (59) “input” (60) “input service” (61) “Input Service Distributor” (62) “input tax” (63) “input tax credit” (64) “intra-State supply of goods” (65) “intra-State supply of services” (66) “invoice” or “tax invoice” (67) “inward supply” (68) “job work” (69) “local authority” (70) “location of the recipient of services” (71) “location of the supplier of services” (72) “manufacture” (73) “market value” (74) “mixed supply” (75) “money” (76) “motor vehicle” (77) “non-resident taxable person” (78) “non-taxable supply” |

Reviews

There are no reviews yet.